Best Crypto Loan Sites 2022

The best crypto loans can be as safe as any traditional loan if you work with a trustworthy loan provider. Most top crypto lenders have millions of dollars in fiat and crypto assets on hand to survive defaults without pain for either lenders or borrowers

Holding crypto is widely seen as a good investment. But holding for the long-term means that you’re giving up cash that you could use for everyday purchases or for alternative investments like stocks and real estate.

Crypto loans offer a solution. With the best crypto loan sites, you can use your digital currency holdings as collateral for a cash loan. Alternatively, many crypto loans sites offer interest-bearing accounts for investors who are willing to lend out their tokens to others.

In this guide, we’ll review the 5 best crypto loan sites in 2022.

The Best Crypto Loan Sites for 2022 List

We’ve tested out dozens of crypto loan providers to bring you the 5 best crypto loan sites for 2022:

1. AQRU - Earn Up to 12% APY By Lending Out Your Crypto

2. Crypto.com - Borrow Against 25 Popular Cryptocurrencies

3. BlockFi - Rates as Low as 4.5% APR

4. Nexo - Earn and Borrow with Interest Rates Up to 20% APY

5. YouHodlr - Borrow at Up to a 90% Loan-to-value Ratio

Loan Platforms with Best Crypto Interest Rates Reviewed

Let’s take a closer look at each of the best crypto loan sites so you can decide which is right for you.

AQRU - Earn Up to 12% APY By Lending Out Your Crypto

_1648550506239.png)

AQRU is a new crypto loan platform that launched in late 2021. It doesn’t yet allow customers to borrow cash against their cryptocurrency, but it offers an attractive interest-bearing account for crypto investors who want to lend out their coins.

With AQRU, you can lend out Bitcoin, Ethereum, USD Coin, Tether, and DAI. Interest rates for USDC reach up to 12% APY, which is roughly 200 times the average savings account interest rate.

AQRU makes it incredibly easy to lend in multiple cryptocurrencies, creating a portfolio with different risk profiles and interest rates. You can deposit any cryptocurrency that AQRU supports, as well as fiat using a bank transfer or debit card. It’s easy to swap between coins using AQRU’s integration with MoonPay and there are no additional fees for doing so. There are also no deposit fees and no withdrawal fees for fiat at AQRU.

Another thing to like about AQRU is that interest is paid out daily. All loans offer flexible holding periods, so you can take back your crypto or reallocate your portfolio anytime you want.

Cryptocurrency markets are highly volatile and your investments are at risk.

Crypto.com - Borrow Against 25 Popular Cryptocurrencies

_1648550594286.png)

Looking for a trusted exchange to buy Bitcoin in 2022? Crypto.com offers both crypto-backed loans and earning accounts for investors who want to lend out their crypto.

With a Crypto.com loan, you can borrow up to 50% of the value of your cryptocurrency holdings. The platform accepts 25 of the most popular cryptocurrencies as collateral, including Bitcoin, Ethereum, Tether, USDC, and more. Interest rates vary, but expect to pay at least 8% APR for most Bitcoin loans.

Crypto.com also enables investors to loan crypto to others with ease. The platform helps you earn interest up to 14.5% APY across a whopping 50 different coins. You can choose from flexible loans that you can withdraw anytime as well as 1- and 3-month lock-in periods. Interest is paid out weekly.

Cryptocurrency markets are highly volatile and your investments are at risk.

BlockFi - Rates as Low as 4.5% APR

_1648550827007.png)

BlockFi is another excellent crypto exchange UK for taking out a Bitcoin loan. It offers some of the lowest crypto interest rates we’ve seen, with loans starting from just 4.5% APR for qualified borrowers. A nice thing about BlockFi is that the platform doesn’t charge prepayment penalties. So, if you want to pay off your crypto loan early to save on interest charges, you can.

BlockFi also offers an earn account with interest rates up to 8.75% APY. The selection of coins to lend and the interest rates aren’t as high as those at AQRU or Crypto.com, but BlockFi appears to be actively improving its offering in this space.

Cryptocurrency markets are highly volatile and your investments are at risk.

Nexo - Earn and Borrow with Interest Rates Up to 20% APY

_1648550890591.png)

Nexo is one of the most lucrative crypto platforms for investors who want to lend out their crypto for a profit. This DeFi platform offers interest rates up to 20% APY with interest paid out on a daily basis. You can lend more than 30 coins, making Nexo extremely flexible for a wide variety of crypto investors.

Nexo also offers some of the best crypto loans we’ve encountered. You can borrow against your cryptocurrency at 0% APR if your loan-to-value ratio is below 20% and you’re a Nexo Gold or Platinum subscriber.

YouHodlr - Borrow at Up to a 90% Loan-to-value Ratio

_1648550954148.png)

YouHodlr is unique among sites that offer crypto collateral loans in that you can borrow at a 90% loan-to-value ratio. This means that if you own $100,000 worth of Bitcoin, you could borrow up to $90,000 in cash.

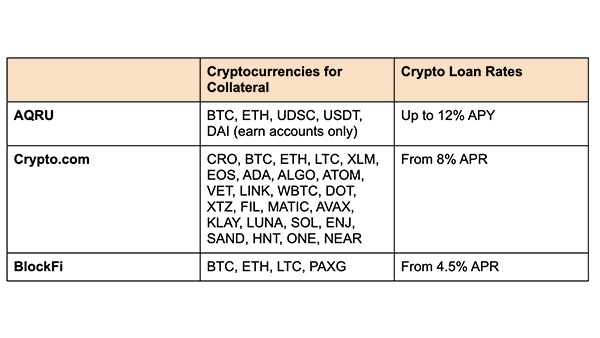

Best Bitcoin Loans Sites Compared

We put together a table comparing the top crypto loan providers so you can easily find the best crypto loan site for you:

How Do Crypto Loans Work?

Crypto loans allow you to borrow cash or cryptocurrency.

The majority of current crypto loans are designed for people who own cryptocurrency and need cash, but don’t want to sell. With a crypto loan, you can borrow against the value of your cryptocurrency holdings in fiat currency. When your loan is repaid, your cryptocurrency is returned to you.

Types of Crypto Loans

There are two different types of crypto loans: those that require crypto as collateral, and those that you can get without any collateral. Let’s take a look at how each type works.

Crypto Collateral Loans

Crypto collateral loans require you to have cryptocurrency in order to borrow cash. All of the best crypto loans we reviewed offer Bitcoin collateral loans.

With this type of loan, you put your cryptocurrency - the collateral - into an escrow wallet that is held by the loan provider. Once your loan is fully repaid with interest, your crypto is transferred back to you. If you fail to pay off your loan, the loan provider will keep your collateral as partial payment.

Crypto Loans Without Collateral

Crypto loans with no collateral don’t require you to put up cryptocurrency or other assets in order to get a loan. Several platforms, including Goldfinch and Aave, offer crypto loans without collateral. They use alternative information such as personal references and credit history to determine who is eligible for a crypto loan and how to set rates.

Importantly, crypto loans with no collateral have much higher interest rates than loans that require collateral. That’s because the lender has little recourse if a borrower defaults. So, the financial risk to the lender is much higher than for a collateralized loan.

Crypto Flash Loans

Crypto flash loans are a type of instant Bitcoin loan without collateral. These loans are similar to traditional personal loans. There’s no collateral required, no guarantees, and very little background checking. In essence, a crypto flash loan is an anonymous Bitcoin loan.

Crypto flash loans typically have very high interest rates.

What Cryptos Can Loan?

Cryptocurrency loan sites want to allow potential borrowers to use a wide range of coins as collateral because it enables more people to access crypto loans. At the same time, crypto lenders prefer coins that are less volatile and that have high liquidity as collateral.

How to Loan Cryptocurrency

Ready to loan cryptocurrency? We’ll show you how to lend your crypto using AQRU:

Step 1: Sign Up for AQRU

Head to AQRU.io and click Sign Up to create a new lending account.

_1648551297825.png)

Step 2: Make a Deposit

AQRU accepts fee-free deposits by credit card, debit card, bank transfer, or crypto.

_1648551392183.png)

Step 3: Lend Crypto

Now you’re ready to lend out your crypto.

_1648551537729.png)

Are Bitcoin Loans Safe?

The best crypto loans can be as safe as any traditional loan if you work with a trustworthy loan provider. Most top crypto lenders have millions of dollars in fiat and crypto assets on hand to survive defaults without pain for either lenders or borrowers.

Cryptocurrency markets are highly volatile and your investments are at risk.

Disclaimer: Cryptocurrency and NFTs are unregulated digital assets and are subject to market risks. The views expressed above are of the author’s and does not reflect the opinion of Hindustan Times or Mint.