Number theory: The role of taxes in the Union Budget

Among the most watched statistics in the Union Budget are previous year’s tax collections and projections for the next fiscal year. Here are five charts that highlight some important points as far as taxes and the forthcoming Union Budget are concerned.

Among the most watched statistics in the Union Budget are previous year’s tax collections and projections for the next fiscal year. Here are five charts that highlight some important points as far as taxes and the forthcoming Union Budget are concerned.

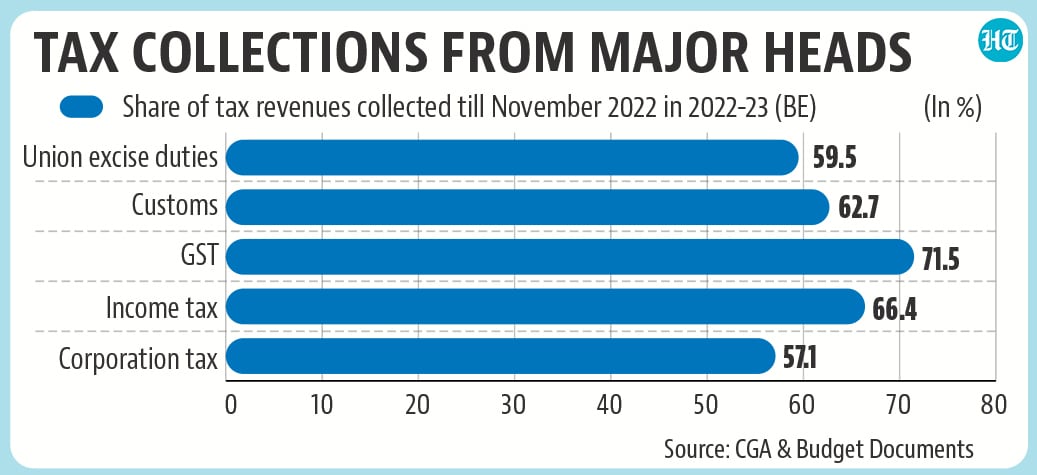

Ideally, tax collections in 2022-23 should exceed Budget Estimates

The 2022-23 Budget assumed a nominal growth of 11.1% for the Indian economy. First advanced estimates of GDP for 2022-23 put India's nominal GDP growth to be 15.4%. Assuming that tax buoyancy - it is change in tax per unit change in GDP- remains unchanged, 2022-23 tax collections should be higher than the Budget Estimate (BE) numbers. Whether it has happened will be known on May 30, when the Controller General of Accounts (CGA), which works under the Union ministry of finance, releases provisional tax collection figures for 2022-23. A comparison of latest data on tax collections - it is available until November 2022-shows that 64.6% of the BE amount has already been collected. This number was 69.5% in November 2021.

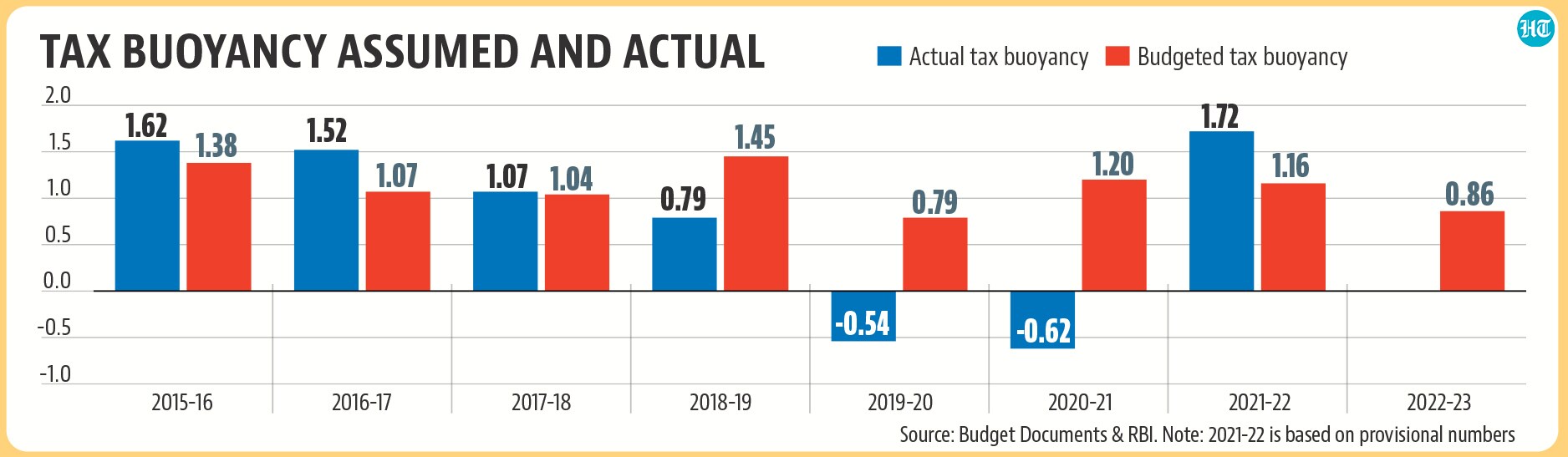

Tax buoyancy assumed in the Budget will be an important number

It is almost a given that the nominal GDP growth in 2023-24 will be lower than what it was in 2022-23. Most forecasters expect India's real GDP growth to slow down in 2023-24 and inflation - the GDP deflator closely follows wholesale inflation - is expected to moderate significantly in 2023-24. If the nominal GDP growth slowdown it significant, it raises a question whether gross tax collections will grow at a much slower pace in 2023-24.

To be sure, nominal GDP growth is not the only driver of overall tax collections, as it also depends on the assumed tax buoyancy. In 2021-22, the actual tax buoyancy turned out to be higher than the assumed tax buoyancy, while this figure was overestimated in the earlier three budgets (since 2018-19). The 2022-23 budget had assumed 0.86. It is to be seen if the government pegs a higher or lower buoyancy number than this figure for 2023-24.

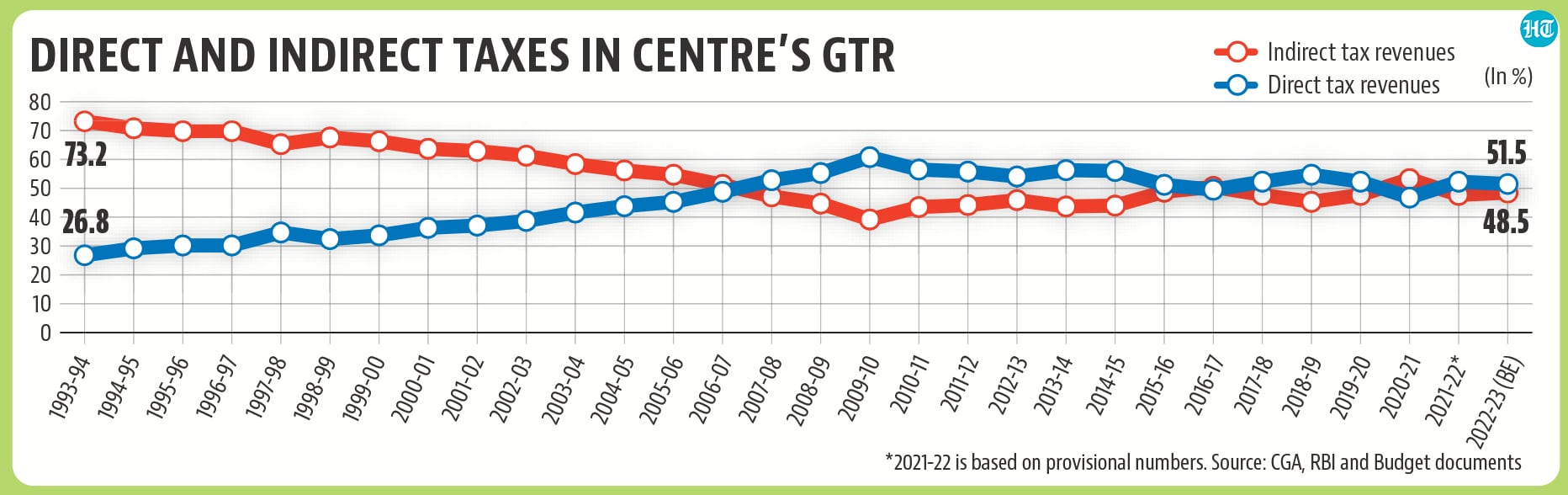

Will direct tax share continue to recover?

Because the rich face a greater burden of direct taxes, a higher share of direct taxes in overall tax revenue signifies a progressive tax policy. A long-term comparison of direct and indirect tax shares in centre's gross tax revenue shows that the share of former increased in the reform period and then started coming down at the beginning of the last decade. There was a brief reversal in this trend, but direct tax share fell to its lowest in 18 years (46.8%) in 2020-21. This number improved to 52.3% in 2021-22, but the budgeted figure was marginally lower at 51.5% for 2022-23. The direct tax projections to be announced in the 2023-24 Budget will be important to look for.

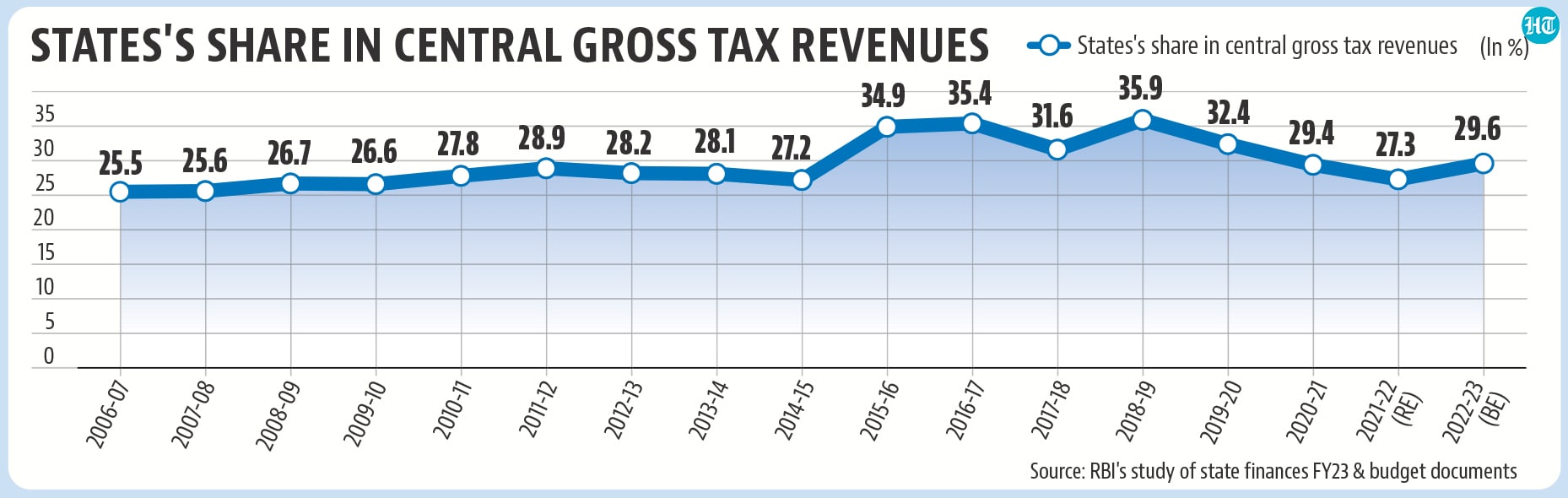

States' share in Centre's taxes is expected to rise in 2022-23

The 15th Finance Commission has mandated that the Centre transfer 41% of its gross tax revenue to states. However, the share of budgetary allocation made for this exercise was 29.6% for 2022-23, which is lower than what was prescribed.

The reason states' share in gross tax revenues of the Centre is lower than the 41% mark is that cess and special duties do not from a part of the divisible pool of taxes. It will be interesting to see what this number is for the 2023-24 Budget.

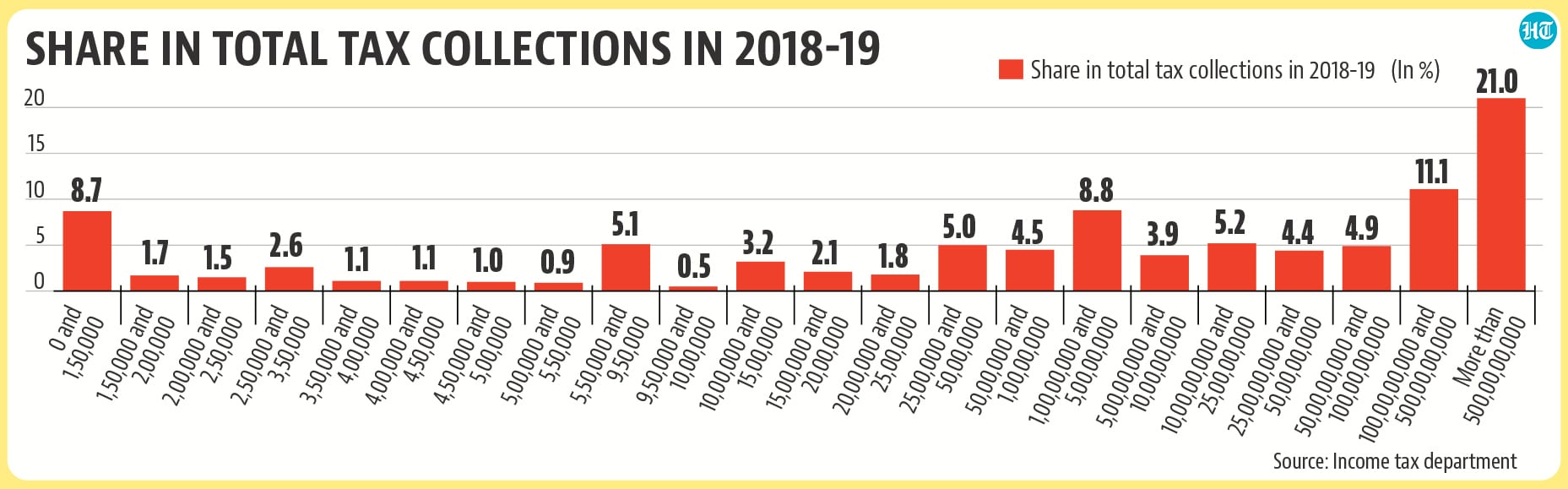

Those earning more than 50 lakh/annum contribute nearly two-thirds of I-T collections

The Union Budget attracts a lot of attention from the salaried class in India due to the possibility of revisions in the income tax slab rates each year. The income tax rates for individuals have not been changed since 2017-18, so it is likely that the government may introduce some changes in tax rates in the upcoming budget. However, an HT analysis shows that any such exercise targeted at the lower end of the income tax slabs may offer marginal returns to the government relative to those on the higher end of the income tax slabs. Income tax return statistics for 2018-19 clearly shows that 82% of tax collections was generated from those tax payers (this includes individuals, companies, firms and others) with income more than 75 lakh per annum. To be sure, 64% of tax collections came from tax payers with incomes above 50 lakh. It is not possible to know these statistics for the latest year due to the unavailability of data at the moment.

Get Current Updates on India News, Lok Sabha election 2024 live, Election 2024 along with Latest News and Top Headlines from India and around the world.